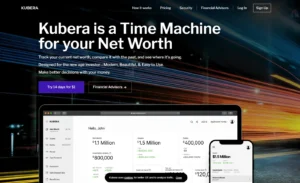

Navigating Investments: Exploring Portfolio Analysis Tools

Introduction:

Investing can be an exciting journey towards financial growth and stability, but it’s also filled with complexities and uncertainties. Whether you’re a seasoned investor or just dipping your toes into the world of finance, understanding your investment portfolio is crucial. That’s where portfolio analysis tools come into play. These powerful resources offer insights and data-driven decisions to help you navigate the often turbulent waters of the financial markets.

Navigating the Financial Sector: A Guide for Everyday Investors secret human2024

Understanding Portfolio Analysis Tools:

Portfolio analysis tools are like your financial compass, guiding you through the myriad of investment options and helping you make informed decisions about your portfolio. They provide a comprehensive view of your investments, allowing you to assess risk, evaluate performance, and optimize your asset allocation.

Key Features and Benefits:

- **Diversification Analysis**: One of the fundamental principles of investing is diversification. Portfolio analysis tools help you assess the diversification of your investments across different asset classes, sectors, and geographic regions. By spreading your investments across a variety of assets, you can reduce the overall risk in your portfolio.

2. **Risk Assessment**: Understanding the level of risk in your portfolio is essential for managing your investments effectively. Portfolio analysis tools use advanced algorithms and historical data to analyze the risk profile of your portfolio. They can identify potential areas of weakness and help you make adjustments to mitigate risk.

3.**Performance Evaluation**: How well is your portfolio performing? Portfolio analysis tools provide detailed performance metrics, including returns, volatility, and benchmark comparisons. By evaluating the performance of individual assets and the portfolio as a whole, you can identify strengths and weaknesses and make informed decisions about your investment strategy.

4.**Asset Allocation Optimization**: Asset allocation is the process of dividing your investment portfolio among different asset classes, such as stocks, bonds, and cash equivalents. Portfolio analysis tools help you optimize your asset allocation based on your investment goals, risk tolerance, and time horizon. By diversifying your investments and rebalancing your portfolio regularly, you can enhance returns while minimizing risk.

5. **Scenario Analysis**: What if the market crashes? Or interest rates rise? Portfolio analysis tools allow you to conduct scenario analysis to assess the potential impact of various market events on your portfolio. By simulating different scenarios and stress-testing your investments, you can better prepare for unexpected market conditions and make adjustments to protect your portfolio.

Choosing the Right Tool:

With so many portfolio analysis tools available in the market, choosing the right one can be daunting. Consider factors such as ease of use, compatibility with your investment accounts, and the depth of analysis provided. Look for tools that offer customizable features, real-time data updates, and robust security measures to protect your sensitive financial information.

https://ahrefs.com/

In today’s complex and fast-paced financial markets, having the right tools at your disposal is essential for success. Portfolio analysis tools empower investors with valuable insights and actionable intelligence to make informed decisions about their investments. By leveraging the power of data analytics and technology, you can navigate the intricacies of the investment landscape with confidence and achieve your financial goals.

So, whether you’re a seasoned investor or just starting out, consider integrating portfolio analysis tools into your investment strategy. With the right tools and a solid plan in place, you can build a resilient portfolio that stands the test of time. Happy investing!

[…] Navigating Investments: Exploring Portfolio Analysis Tools secret 2024 […]