Exploring the Differences Between BSE and NASDAQ: A Stock Exchange Comparison

When it comes to investing in the stock market, understanding the various exchanges is crucial. Two significant players in the global market are the Bombay Stock Exchange (BSE) and the NASDAQ. While they both serve as platforms for buying and selling securities, they have distinct characteristics that make them unique. In this post, we’ll dive into a comparison of the BSE and NASDAQ to shed light on their similarities, differences, and what sets them apart.

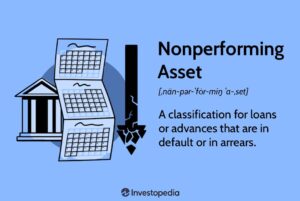

Navigating Non-Performing Assets: Strategies for Effective Management secret human 2024

Overview of BSE and NASDAQ

**Bombay Stock Exchange (BSE):** The BSE is the oldest stock exchange in Asia and is based in Mumbai, India. Established in 1875, it has a rich history and is one of the largest stock exchanges in the world by market capitalization. The BSE primarily facilitates trading of equities, derivatives, and debt instruments.

**NASDAQ:** The NASDAQ, on the other hand, is based in the United States and is known for its focus on technology and growth-oriented companies. It was founded in 1971 and is considered the world’s first electronic stock market. NASDAQ is renowned for listing many high-profile tech companies like Apple, Amazon, and Google.

### Listing Requirements

One of the key differences between the BSE and NASDAQ lies in their listing requirements.

**BSE:** The Bombay Stock Exchange has relatively stringent listing requirements, which often make it more challenging for smaller companies to list on the exchange. Companies seeking to list on the BSE must meet certain financial criteria and comply with regulatory standards set by the Securities and Exchange Board of India (SEBI).

**NASDAQ:** In contrast, NASDAQ is known for its more lenient listing requirements, particularly for technology startups and growth-oriented companies. While NASDAQ does have certain financial standards, it tends to be more accommodating to companies that may not meet the criteria set by other exchanges.

### Market Structure

The market structure of BSE and NASDAQ also differs significantly.

https://ahrefs.com/

**BSE:** The Bombay Stock Exchange operates on a traditional trading floor model, where brokers physically execute trades on the exchange floor. While electronic trading has become more prevalent in recent years, the BSE still retains elements of traditional floor trading.

**NASDAQ:** NASDAQ, on the other hand, is entirely electronic and operates through a network of computers and servers. This electronic trading model allows for faster execution of trades and greater liquidity compared to traditional exchanges.

### Investor Base

The investor base of BSE and NASDAQ also reflects their respective regions and market characteristics.

**BSE:** The Bombay Stock Exchange primarily caters to investors in India and surrounding regions. It attracts a diverse range of investors, including retail investors, institutional investors, and foreign investors interested in gaining exposure to the Indian market.

**NASDAQ:** NASDAQ, being based in the United States, has a more global investor base. It is especially popular among institutional investors and hedge funds seeking exposure to technology and growth stocks.

### Conclusion

In conclusion, while both the BSE and NASDAQ serve as important platforms for trading securities, they have distinct characteristics that differentiate them from each other. The BSE, with its rich history and stringent listing requirements, appeals to investors interested in the Indian market. Meanwhile, NASDAQ’s focus on technology and growth companies, along with its electronic trading model and lenient listing requirements, make it an attractive option for investors seeking exposure to the U.S. market.

Understanding the differences between these exchanges is essential for investors looking to diversify their portfolios and capitalize on opportunities in different regions and industries. By considering factors such as listing requirements, market structure, and investor base, investors can make informed decisions when navigating the complex world of stock market investing.

[…] Exploring the Differences Between BSE and NASDAQ: A Stock Exchange Comparison secret 2024 […]