FINANCE

Demystifying Finance: A Guide to Understanding Your Money Matters

Introduction: Finance. The word alone might conjure up images of complex algorithms, intimidating graphs, and incomprehensible jargon. But fear not! Finance is simply the management of money and the study of how it’s allocated over time. In this guide, we’ll break down finance into digestible pieces, helping you navigate the world of personal and business finances with confidence.

Inside the NBA Trade Deadline: What Fans Need to Know secret 2024

Understanding Personal Finance: Let’s start with the basics: personal finance. It’s all about managing your money to achieve your financial goals. Whether it’s saving for a dream vacation, buying a home, or planning for retirement, personal finance is the roadmap to get you there.

Budgeting: At the core of personal finance is budgeting. Think of your budget as a financial blueprint that outlines your income and expenses. By tracking where your money is coming from and where it’s going, you can make informed decisions about your spending habits and savings goals.

Saving and Investing: Saving is the foundation of financial security. It’s important to set aside a portion of your income for emergencies and future expenses. But saving alone isn’t enough. Investing allows your money to grow over time through avenues like stocks, bonds, mutual funds, and real estate. Understanding your risk tolerance and investment options is key to building long-term wealth.

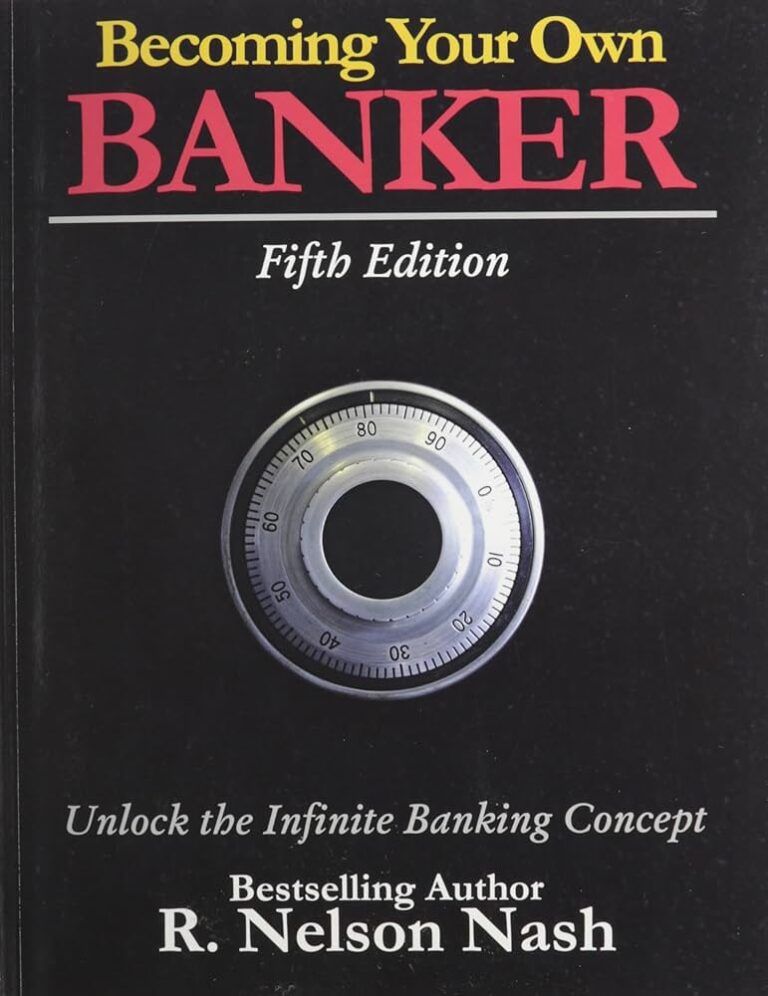

Managing Debt: Debt can be a daunting aspect of personal finance, but it doesn’t have to be overwhelming. Whether it’s student loans, credit card debt, or a mortgage, developing a repayment plan can help you take control of your financial future. By prioritizing high-interest debt and making consistent payments, you can work towards becoming debt-free.

Planning for the Future: Retirement may seem like a distant goal, but the earlier you start planning, the better off you’ll be. Employer-sponsored retirement accounts like 401(k)s and individual retirement accounts (IRAs) offer tax advantages and compound interest benefits that can help you build a comfortable nest egg for your golden years.

Understanding Business Finance: While personal finance focuses on individual financial decisions, business finance deals with the financial management of organizations. From small startups to multinational corporations, understanding the principles of business finance is essential for success.

Financial Statements: At the heart of business finance are financial statements: balance sheets, income statements, and cash flow statements. These documents provide a snapshot of a company’s financial health and performance. Analyzing financial statements can help businesses make strategic decisions, attract investors, and secure financing.

https://ahrefs.com/

Budgeting and Forecasting: Businesses must carefully manage their budgets and forecast future financial performance. By anticipating expenses, revenues, and cash flow, companies can allocate resources effectively and plan for growth opportunities. Budgeting and forecasting help businesses stay agile in a dynamic marketplace.

Capital Structure and Financing: Determining the optimal mix of debt and equity financing is crucial for business sustainability. Capital structure decisions impact a company’s risk profile, cost of capital, and shareholder value. Whether through loans, bonds, or equity investments, businesses must weigh the pros and cons of different financing options.

Risk Management: Every business faces a myriad of risks, from market volatility to regulatory changes to natural disasters. Risk management strategies help businesses identify, assess, and mitigate potential threats to their operations and financial stability. By diversifying investments, purchasing insurance, and implementing internal controls, companies can protect against unforeseen events.

Conclusion: Finance doesn’t have to be daunting. By understanding the fundamentals of personal and business finance, you can take control of your financial future and make informed decisions that align with your goals and values. Whether you’re managing your household budget or leading a multinational corporation, the principles of finance apply across the board. So arm yourself with knowledge, seek guidance when needed, and embark on your journey to financial empowerment. Your future self will thank you for it!

[…] Demystifying Finance: A Guide to Understanding Your Money Matters secret 2024 […]